Markets reward the long term investor. That’s it. Easy, but not simple.

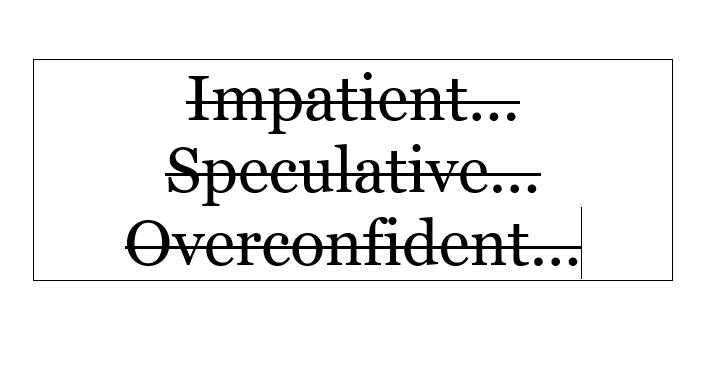

The stock market doesn’t like to reward the impatient investors, the speculative investors, or the overconfident investors. Sure, you can get lucky and pick a hot stock and ride it up for a while, but odds are if you have played that game enough times you have realized it can be just that, a game. Sometimes you win, sometimes you lose. It can be fun some of the time and stressful most of the time.

There are no guarantees in investing and there are especially no guarantees investing in individual stocks. For example, while the broad US Stock Market (as measured by an index called the S&P 500) is up over 20%, that does not mean that every stock in the US is having a good year. Those Teslas that you keep seeing more of on the road? Their stock is down 31% this year. The Gap clothes everyone is buying for back to school? Their stock is down 31.9% year to date. But, you can greatly increase your odds of a positive expected rate of return by diversifying your holdings and being patient.

It is also helpful to remember that investment accounts are called invested assets for a reason. They are supposed to stay invested. They are not called “only if they’re going up assets” or “money I need next month.” Accounts that only increase in value are not investments, they are guarantees, such as a savings account backed by the FDIC. A healthy, guaranteed savings account is a critical part of a good financial plan, as well as lack of debt, strong insurance policies, and good savings habits. All these parts of your financial plan exist to provide security. Investment accounts provide the vehicle to have your money grow at a higher expected rate of return over a long period of time so you can progress toward financial freedom. And, as Mr. Buffet has taught us, when you own a good portfolio of investments the recommended holding period is “forever.”

Returns as of September 5, 2019. Source: FactSet. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. All indices are unmanaged and investors cannot invest directly into an index.