It is tax time on Logic Lane and the perfect time to introduce three families asking the same question as they pull together all the documents. Between the W2s, 1099s, K1s, their earnings add up to $400,000. A great income, but they all have the same question, “Where did it go?”

While this article is intended to be timeless, we are mindful that 2020 was if nothing else, a disruptive year for personal finances. Depending on the sector or specialty of the US economy in which you work, you could have had your worst year ever or best year ever. You might have had to leave the workforce to care for children or your company could have gone out of business. The intent of the wisdom from Logic Lane is to be an enduring, timeless voice of calm and reason. This story could just as easily be about three single individuals earning $40,000 or $4,000,000 per year, because as you will see, it isn’t so much as what you make, as what you spend.

The three couples we will get to know who are questioning where it all went are not unlike most Americans who sign their name on the tax return, glance at the Taxable Income figure, and pause for a moment. You may wonder: is it enough? Should it be more? How much of it did we save? How much of it did we spend? Why does the government take so much? Where did it all go? Mostly, are we doing OK? The tax return tells a story of our lives – how we spent our time and earned an income, if a child was born, if we started a business, if we lost a loved one or if a home was sold. What it doesn’t tell us is where all the money went.

At first glance these families appear quite similar, but when it comes to what is most important to live a happy life, they have little in common. Because they have different values, priorities and life experiences, their financial lives are vastly different. The thing they have in common? They are all incredibly happy with where they are financially and even if offered the opportunity, wouldn’t trade places with anyone.

With that introduction, meet Economical Eric and Evie, Balanced Brett and Beth, and Spending Steve and Sarah. They are all 48 year old dual working mid career professionals with three children ages 18, 15, and 12, earning a combined $400,000 living in the same major US city. They will show us how there is no right way, simply different ways to build and manage wealth. They have each invested the time to design a plan which reflects what matters to them and are living their best lives without regret. Does Economical Eric think that Spending Steve is nuts? Sure, but isn’t that what neighbors commonly think about one another? He is also a great friend, the life of the party and he doesn’t complain that he never pays for a beer when Steve is around.

So why take the time to understand where it all went? If you are like Brett and Beth, you have worked several decades to earn a great income. You went to school, maybe graduate school or medical school, climbed in your career, started and grew your family and now earn a great living. As they put it, “We only get one shot at this life, might as well put some thought around how we are doing it. We don’t want to work hard to climb a ladder and realize it was leaning against the wrong wall.” We happen to agree. The other reason is that it is really challenging to understand what one should or could be doing, when real wealth is invisible. You cannot look around to your friends and family and figure any of this out. What is projected to the world with how we live our lives and spend our money has little to do with how little or how much money we have. All we really know from how much someone spends is how much money they no longer have.

If you are a client of our firm, you know how much time we spend on helping you to understand your cash flow, informing and empowering you to make big changes to live your most fulfilling life. But we do warn people, once you understand your cash flow and align it with what is most important in this “one wild and precious life,” you might start doing crazy things. You may make better decisions about your career, how you spend money, and how you spend time. You may even have fewer disagreements with your spouse about money*. You might have to find something new to worry about other than the credit card bill and the 401(k) balance. Consider yourself warned.

Let’s take a deeper look at these three couples and help them answer the question of, “Where did it go?”

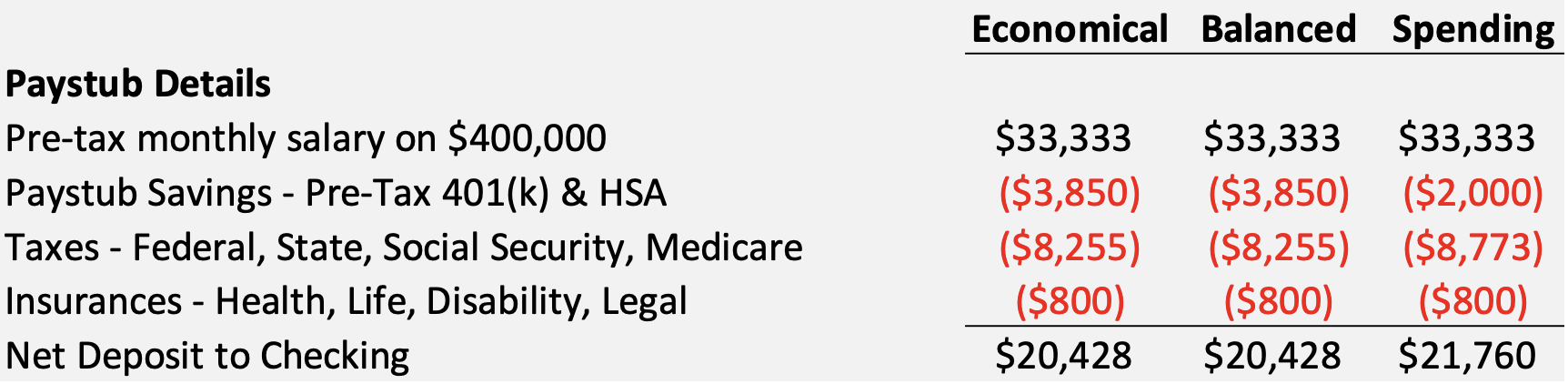

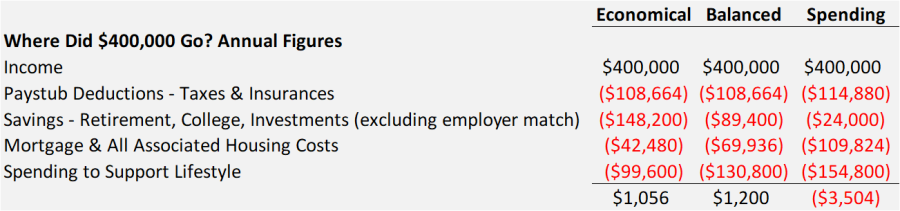

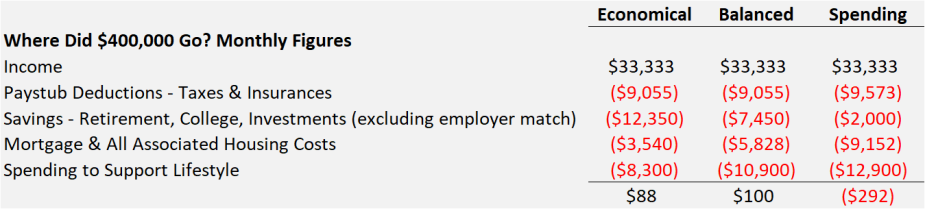

1. Cash Flow. It all starts with cash flow. Each couple earns the $400,000 annually as employees, or $33,333 pre-tax per month. After 401(k) contributions, health insurance premiums, federal and state taxes, Social Security and Medicare, FSAs, HSAs, Dependent Care FSAs, group insurances, they arrive at the figure deposited into their checking account listed in the chart below. The only difference is Eric, Evie, Brett and Beth all make the maximum contribution to their 401(k)s ($19,500 annually) and HSAs ($7,200 per family annually), and Steve and Sarah contribute the minimum 3% to get the full match and pass on the HSA. Evie makes the comment that this is a point of contention in their household. She tells Eric he needs to stop harassing the HR Department to see if he can start making his additional 401(k) $6,500 catch up contributions early. Do they really need to tell him again that he is only 48 years old and no, the laws about additional retirement savings at age 50 have not changed because of Covid?

They each end up with $20,000 – $22,000 per month (roughly $252,000 annually) deposited to their checking account.

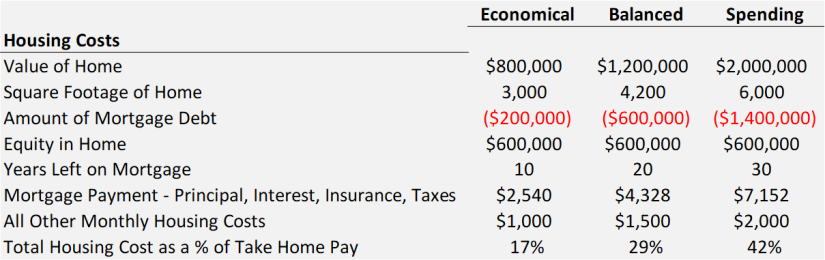

2. House Payment. (chart below) $20,000 take home pay per month, where did it all go? The biggest driver of savings, spending, and wealth accumulation from your 30s to 60s is highly correlated to what percent of your take home pay is spent on housing. Not just your mortgage payment, but all housing costs including HOAs, all utilities, landscaping & maintenance, house cleaning, home repairs, home furnishings, home improvements, etc. A home can be a great investment depending on where you live and if you have any plans to extract your equity to fund your financial independence, and it can also be an endless way to spend money. We all need somewhere to live, but how much a family spends on housing can have a significant impact on the ability to save money and have the discretionary income to really enjoy the wealth you work so hard to earn.

So how much do Eric and Evie, Brett and Beth and Steve and Sarah spend on housing? Never enough according to the Steve and Sarah and always too much for Eric and Evie. All three couples refinanced in 2020 to a low interest rate and reset their mortgage terms. Economical Eric and Evie are in the same house they bought at age 35 and refinanced to a 10 year loan at 2%. They pay $250 per month for insurance, $500 per month for taxes, and $1,000 on all other housing costs. One of Eric’s favorite ways to save is that he only shops once a year on Cyber Monday sales for any large home improvements or updating appliances. Their total housing costs are 17% of their take home pay. They plan to be debt free in 10 years at their youngest’s age 22 and when they are both 58 years old. They may move at that point, but they plan to pay cash for their new house, and where could they find a place as reasonable to live as Logic Lane?

Balanced Beth and Brett upgraded their home a few years ago and refinanced to a 20 year mortgage to lock in a low interest rate and have the forcing mechanism to pay down their debt faster. They could have done the 30 year, but when they were 48 and signing a mortgage, and they thought hard about their future selves. They may stay in the house indefinitely, or downsize, but they didn’t want to set themselves up that they had to sell the house to retire. They plan on working until their mid to late 60s anyways and buying this beautiful home was a high value of theirs. They love the house and every day it makes them happy. Their loan is at 3%, monthly insurance of $300, taxes of $700 and other housing costs of $1,500 brings their total housing cost to under 30% of their take home pay. They knew they could go less expensive or more expensive when looking for a new home, but this was the sweet spot of what they wanted with what they could comfortably afford.

Spending Steve and Sarah love real estate and take the philosophy that to make big money, you have to take big risks. They have continuously traded up their properties with each big promotion and they bought the $2,000,000 dream home and could not love where they live anymore. They refinanced last year to a 3%, 30 year, $1,400,000 mortgage, which means they will not have their home paid off until close to their age 80. 80 you say? They are 48! Carpe diem! They don’t plan on staying in this house long term so the fact that 42% of their take home pay goes to housing costs is irrelevant. They spend $350 on insurance, $900 on taxes, and $2,000 on other housing costs per month. Sarah and Steve have the best parties on all of Logic Lane but sometimes the neighbors question why they want to live there.

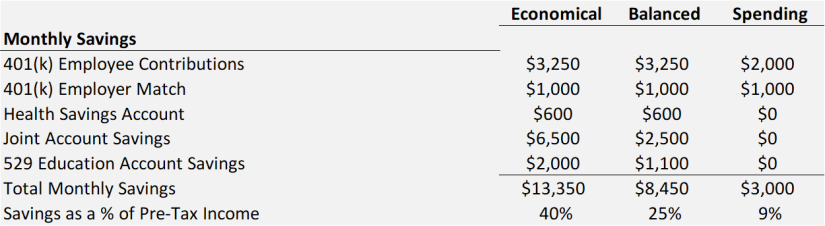

3. Monthly Savings and Personal Balance Sheet As you can imagine, how much the three families save varies widely. If you give Eric the time, he will be happy to pull up his Google Sheet on his phone at the neighborhood happy hour and show you how much of his income he has translated into wealth not only last year, but every year since he graduated college in 1995. Steve likes to give Eric a hard time that he should get a tattoo with “40% Savings For Life” on his arm, but Eric laughs and replies, “That will never happen. Tattoos are not in the budget.”

Starting this time with Steve and Sarah, their value is in enjoying their lives to the fullest with no intention to retire. Things tend to work out for them, and they have seen so many of their parents’ friends never make it to retirement that they do not want to forego any experiences today to save more for their future, which is not a guarantee. They each put 3% into their 401(k) to get the match from their company, and occasionally throw money into the 529s for the kids. Their savings rate is 9% and their projected retirement is most likely never, but roughly around age 80 would they have enough to support $15,000 per month withdrawals. This sounds great to them. They see how unsatisfying retirement can be, they love their work, and are more concerned about where they are going for summer vacation than what their monthly income will be in 32 years.

For Brett and Beth, it is very important to always be financially secure and planning for their future and their children’s educations, but they also derive a lot of joy from spending their money on experiences today. They take the philosophy to spend money on doing stuff vs. having stuff. They also have no problem on spending money to make their lives a little easier and to spread joy to those people and organizations they love. Their savings rate is 25% and they are on track to retire in 17 years at their age 65 with a nest egg of about $4,500,000 and a (mostly) paid off house. This may shift depending on where the kids go to school, if Beth decides to retire earlier because of her health issues which can make work less enjoyable and what, if any, inheritance they receive. All they know is they are living their lives aligned with their values today and so while it isn’t perfect and they know there are plenty people with much more than they have, it is good enough for them.

Eric and Evie have been reading Money Magazine cover to cover since they were in college and have implemented every strategy to save and invest as much money as possible. During the market recession in 2008 – 2009 they even cancelled all their subscriptions so they could invest even more money into the market when the world was on sale. Their family vacations consist of road trips to visit family and friends, stopping only at grocery stores to refuel the cooler of sandwiches, they rarely dine out and if they do, everyone gets water to drink. Who pays $4 for a root beer and $15 for one glass of wine? Crazy people. That’s who, according to Evie. She says she prefers not to set money on fire. They know their savings rate of 40% is not for everyone, but they are really starting to see the fruits of their labor and the fact that they will be able to not only put all the kids through school, but will have the house paid off and be able to retire before the age of 60. They are on track to have a nest egg of $5,000,000 in 10 years, and be completely debt free with their youngest hopefully having graduated college. Now the only thing Evie needs to do is convince Eric to go get a part time job at a budgeting center with health insurance benefits at age 58.

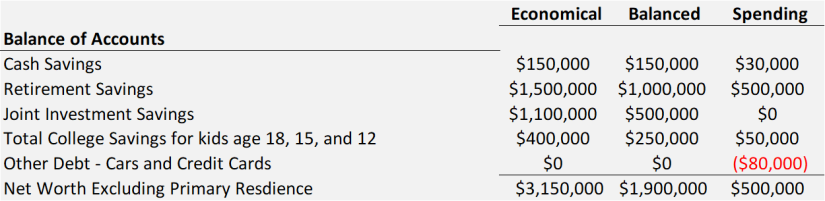

Which one is winning? Which one is doing it right? How much you have saved by the time you are 48 years old has a lot to do with what you have done for the past 26 years of adulthood. How long have you been working? What work did do you do? Did you go to Graduate school? Medical school? Did you get married? Divorced? Did you change careers? Did you take time out of the work force to raise your kids? Did you not work outside of the house? Did you take a sabbatical? A leave of absence to care for a sick parent? An illness or injury yourself? When it comes to accumulating wealth, it is rarely, if ever, a straight line. As you can see below, the three couples’ personal balance sheets show what different habits, compounded over several decades, result in by your late 40s.

4. Spending – This is what the residents on Logic Lane know, as the unsung hero of personal finance. It isn’t what you make, it’s what you spend. Understanding where all the money goes monthly is one of the biggest keys to financial freedom during your wealth accumulation years.

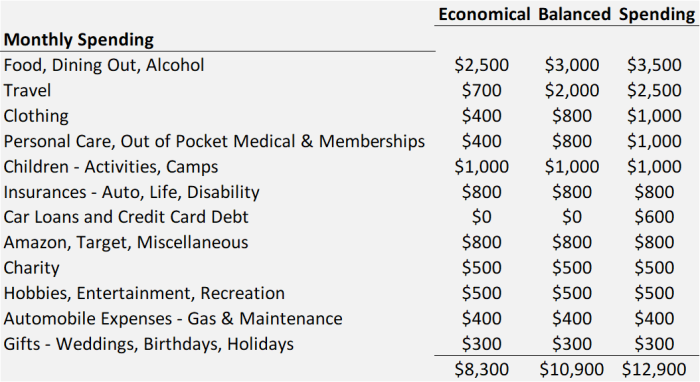

As you can see from the chart below, while the families spend the same amount on many items – gifts, car maintenance, hobbies, charitable donations, Amazon, Target, insurance policies, and kids’ activities, they do vary in several other key areas of spending.

Brett and Beth don’t think twice about what they spend at the grocery store or liquor store, but are aware of how frequently they dine out per month at restaurants. With their philosophy of spending their money of doing stuff vs. having stuff, they allocate $24,000 annually for travel as a family. This is 6% of their income and their happiest spending of the year. Their average credit card bill is $10,000 and they keep a cash reserve of $150,000 which they built up from years of saving $2,500 per month. Once their cash reserve was solid, they started saving to their joint investment account.

Eric and Evie prioritize saving first, spending second. Their average credit card is $7,500 and Eric does a victory lap around the kitchen island whenever it is less. 2020 was his favorite year ever with how little he had to spend. He went three months without filling up the gas tank. He keeps a spreadsheet of how much he has spent on each child over their lives and plans on sharing it with them when they graduate from college. Evie threatens him with his life if he does this, but it is a good trick to have up his sleeve to get her all fired up. They love their life and feel very comfortable with where they are at and don’t really know how they could spend more.

This is the first time Steve and Sarah have ever considered what they spend. They don’t like that they have credit card debt, but assume that everyone does. They rarely cook, love to travel, are always dressed in the best fashions, and their skin is always glowing and never will they have a crick in their neck. They drive luxury cars and spend $30,000 per year on travel. They love their lives and while they understand they are living paycheck to paycheck on $400,000 per year, they feel confident that they can always make more money.

5. Bringing it all together –Where did it all go? The two charts below sum it all up on an annual and monthly basis. Who knew that by understanding that if you typically spend $400 per month on Amazon and $400 per month at Target that we could discern where a year’s worth of work and $400,000 went? With such different spending, saving, and investing habits, is one of the couples winning? Should Eric be questioning his choices because of Steve’s great tan and vacation pictures, or should Beth be envious of Evie’s plan to retire in 10 years? Or is each designing a financial life to reflect their highest priorities as a family and spending, saving, and investing accordingly?

What we didn’t know as we were reading this was that Eric and Evie’s parents died young which was exceptionally formative. They value financial independence and being able to control their time above all else and as a result, they want to be financially independent as soon as possible. Steve and Susan had a close aunt and uncle that they loved who denied themselves all frivolous spending to save and plan for the future. That future never happened and they both got sick before they could enjoy the millions they had saved to travel the world. Brett and Beth did not have the best childhood and can’t believe they are financially in such a great position. They never dreamed they would be where they are and so they are cautiously optimistic about the future, but know how quickly life can change.

Having helped dozens of high income, busy families with big dreams navigate this question, there is no right answer. Life doesn’t come with a checklist of how to manage your money; and the most important parts of life – and the most valuable assets – are not on spreadsheets.

Going about your complex financial life without a plan or a shared vision for what you are creating is a sure-fire way to introduce confusion, stress, and conflict. When your vision is clear, your decisions are easy. When your vision is unclear and undeveloped, you make our way through adulthood winging it, stressing over finances and yelling at the credit card statement. This can result in a lot of sleepless nights, wondering if you can put the kids through college, or how you will pay for your big family vacation.

When you have Guidance For Your Goals™, it simply makes the money part of your life a place of calm and direction, and even great happiness. It allows you to focus on what you do best, on raising your family, on connecting with your spouse, taking care of yourself and making your mark on the world, because you know the money stuff is doing what it should.

While the world of finance can appear unnecessarily complicated, most of us cannot answer the simplest question of, “You have worked your whole life to earn $X. What do you do with all of it?” And the world of finance can become so focused on the most interesting investment of the day, but if you don’t have the money to put into that investment, what does it matter?

As you have read and look at the charts, you now understand that there is no correct or winning way to manage your money and your priorities, it is a matter of having a plan for which strategy you are implementing and doing so with great joy. Spenders can live life to its fullest today and accept that they will continue to work beyond what society has dubbed an expected retirement age, Savers can’t wait to retire early and control their time at the price of spending and enjoying now. The balanced approach provides some of the benefits and downsides of each approach. Each strategy has its pros and cons, risks and rewards, and the right answer for your family will be the wrong fit for the family next door. What matters in the end is having a clear vision for what it is you want to create and experience with your life, create a plan and then get out there and enjoy it.

*no guarantees 😉